In some cases, you may want to charge taxes on delivery orders based on the location they are delivered to, rather than the store location. This meets location-based tax requirements in several states (including Washington State), automating the tax calculations—so you don’t have to count on employees’ lookup and math skills. Follow the procedure below to charge a different tax rate for deliveries to certain delivery zones.

To Charge Taxes Based on Delivery Location

|

Caution Tax changes should be made only after running day end or before making any sales the next day. |

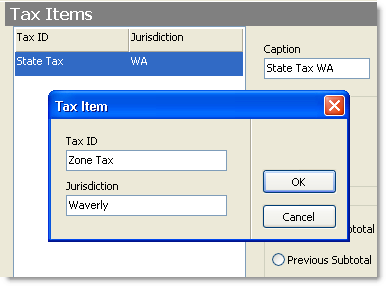

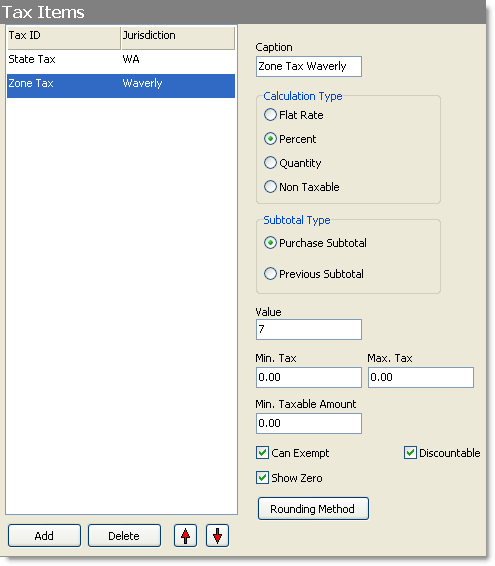

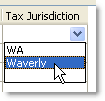

| 1. Add a new tax item for the delivery zone where the tax is to be charged, and enter a jurisdiction. |

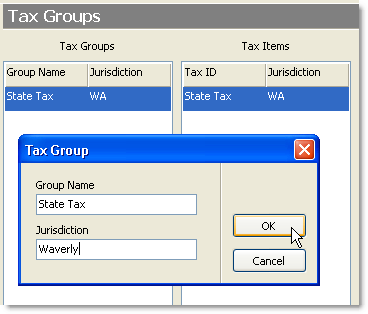

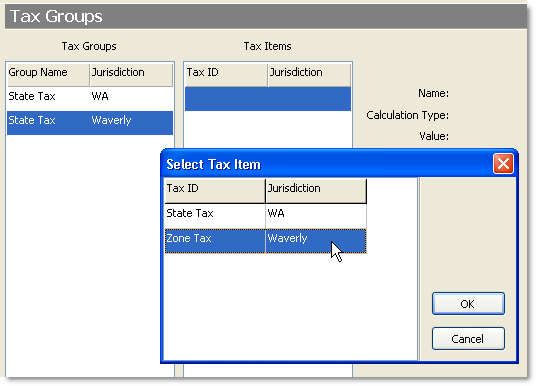

a.Go to Settings> Money> Tax Groups. b.Under the Tax Groups pane, click the Add button  c.In the Group Name field, type the name of the tax group that applies to items in your menu, for example "State Tax."

d.In the Jurisdiction field, type the same jurisdiction you entered for the zone tax item in step 1d. above. Click OK. e.Under the Tax Items pane, click the Add button  f.Select the delivery zone tax item you created in the Add a new tax item for the delivery zone step above, and then click OK. g.If you have more than one tax group in your menu that will apply to items in this tax zone, repeat steps 2b to 2f to add groups with the tax zone jurisdiction. h.On the Edit menu, click Save Changes. |

|

Caution Tax changes should be made only after running day end or before making any sales the next day. |

5.Refresh Terminal. The tax rate for the delivery zone will be applied when an order's type and delivery zone match those specified.